MANAGERIAL ECONOMICS- MEANING, FUNDAMENTALS AND FRAMEWORKS

What is Managerial Economics?

Managerial economics is deemed to apply economic theory and principles to business decision-making. It is concerned with the use of economic analysis for the formulation and solution of business problems.

Managerial economics is a relatively new discipline, emerging from the work of economists in the early 20th century who recognised that businesses faced unique decision-making problems that could not be addressed using traditional economic theories. Over time, managerial economics has developed into a distinct field of study with its knowledge and analysis methods.

While there is no single definition of managerial economics, it can be broadly described as applying microeconomic analysis to business decision-making. Managerial economists use economic theory and principles to analyse business situations and make decisions about pricing, production, investment, and other strategic issues.

Definitions of Managerial Economics

L. Pappas and E. F. Brigham wrote a managerial economics book entitled “Managerial Economics: An Introduction”. They define managerial economics as “the application of economic analysis to decision-making within an organisation”, emphasising that it should aid managers’ decisions to increase organisational efficiency and profitability.

Furthermore, they emphasise the importance of managerial economics for understanding market forces such as demand curves and production costs about pricing strategies, resource allocation policies and forecasting methods for making informed financial management decisions. They also note that while it is essential to consider both microeconomic and macroeconomic factors when making decisions, attention must also be given to how these issues affect the business environment within the organisation.

In another work, Dr Amir Hachemi defines managerial economics as “the branch of economics that deals with applying economic principles to business management practices”. He further adds that it is concerned with analysing how resources are allocated and utilised within a firm to maximise profits and efficiency, emphasising the importance of understanding the implications of various economic theories and models on managerial decision-making.

Explain The Concept of Managerial Economics

Managerial economics, in simpler terms, is the application of economic principles and methods to business decision-making. It is concerned with how managers use economic concepts and tools to make sound business decisions.

Managerial economics bridges the gap between the theory of economics and managerial practice. It draws upon microeconomic theory to recommend how to operate a business most efficiently. It also applies microeconomic analysis to specific managerial decisions, such as pricing, product mix, capital budgeting, etc.

In addition, managerial economics uses econometric techniques to estimate demand, forecast future market conditions, and test hypotheses about causal relationships. This information can improve decision-making in various areas, such as production planning, marketing, financial management, and human resource management.

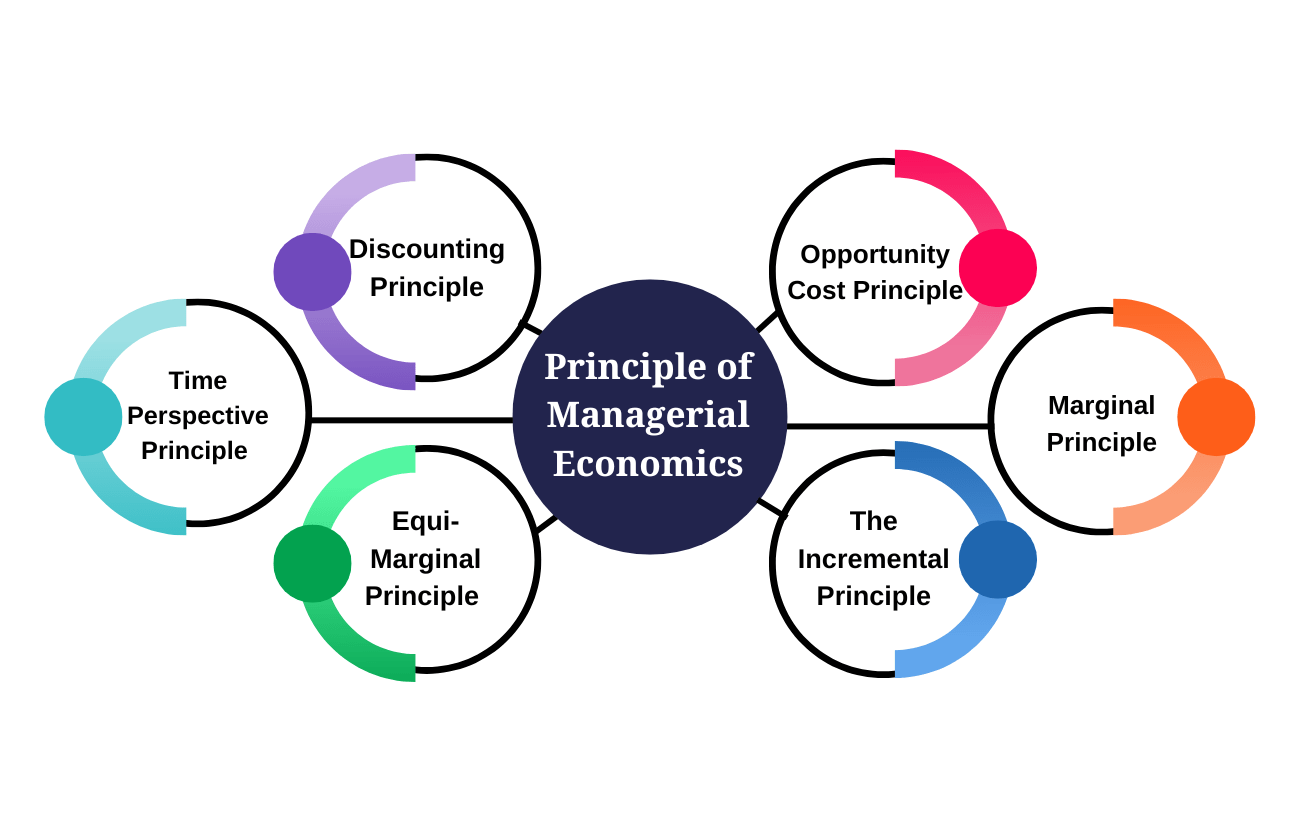

Principle of Managerial Economics

The Incremental Principle

The Incremental Principle is one of the most important concepts in managerial economics. It states that decision-makers should always choose the option that provides the most incremental benefit or the option that provides the greatest increase in benefits over the next best alternative.

This principle is especially important when making decisions about investments and other long-term projects. For example, if a company is considering two different investment options, it should choose the option that is expected to provide the highest return on investment.

The Incremental Principle can also be applied to personal decision-making. For instance, if you are trying to decide whether to save money for a down payment on a house or retirement, you should choose the option that will provide the most incremental benefit (in this case, saving for retirement).

An Incremental Principle is a powerful tool that can help you make well-informed decisions in your personal and professional life. When making any decision, ask yourself: what is the most incremental benefit?

Marginal Principle

Managerial economics, or applying economic principles to business decision-making, is a relatively young field. It first emerged in the early 1900s as businesses began to adopt scientific methods to solve problems and make decisions.

The marginal principle is one of the essential concepts in managerial economics. It states that businesses should make decisions by considering each option’s marginal benefits and marginal costs. In other words, businesses should compare the additional benefits of an option to its additional costs and choose the option that provides the most benefit for the least cost.

This principle can be applied to various business decisions, from production and pricing to investment and financing decisions. The key is to always consider each option’s incremental benefits and costs before making a final decision.

Opportunity Cost Principle

The opportunity cost principle is a cornerstone of managerial economics. It states that decisions should be based on the opportunity cost of resources, not just the monetary cost.

The opportunity cost principle is relevant to both individuals and organisations. For individuals, it means that decisions should be based on the opportunity cost of time and effort. For organisations, it means that decisions should be based on the opportunity cost of capital and other resources.

The opportunity cost principle is used in various decision-making situations, including investment, production, and resource allocation decisions. In each case, the goal is to make the best use of resources by considering all of the potential costs and benefits.

The opportunity cost principle is essential for managers who want to make sound decisions that maximise value for their organisations. By considering all of a decision’s potential costs and benefits, managers can make choices that will result in the best possible outcome for their companies.

Also Read: What Are General Management Courses?

Discounting Principle

The Discounting Principle is one of the essential principles of Managerial Economics. It states that the present value of a stream of future cash flows is always less than the future value of those cash flows. This is because money has time value – it is worth more today than it will be in the future. This principle is used extensively by businesses when making investment decisions, as well as by individuals when making personal financial decisions.

There are several reasons why the discounting principle is so important. Firstly, it takes into account the fact that people prefer to have money now rather than later. It is because people can use the money now to buy goods and services they may not be able to afford.

Secondly, the discounting principle also considers that money invested today will earn interest over time, meaning that it will be worth more in the future. Finally, the discounting principle considers inflation – as prices rise over time, money will lose its purchasing power and be worth less.

The discounting principle is used extensively in business and finance. Businesses use it to make investment decisions, as they need to ensure that they invest their money in projects that will generate enough return to justify the initial investment. Individuals use the discounting principle when making personal financial decisions, such as saving for retirement or paying off debts.

Time Perspective Principle

The Time Perspective Principle is a fundamental principle of managerial economics that states that an individual’s decisions are influenced by their perceptions of time. This principle dictates that individuals make decisions based on their present situation, prospects, and past experiences. Individuals with a positive time perspective focus on the present and future, while those with a negative time perspective focus on the past. The Time Perspective Principle is essential for managers, as it can influence an individual’s willingness to take risks and make investment decisions.

Managers need to consider an individual’s time perspective when making decisions, as this can significantly influence the outcome. For example, a manager who considers an individual’s positive time perspective may be more likely to make decisions that lead to future successes. On the other hand, if a manager ignores an individual’s negative time perspective, they may make decisions that put the organisation at risk or lead to short-term gains with long-term losses.

Overall, the Time Perspective Principle is a valuable tool for managers when making decisions. By understanding and considering an individual’s time perspective, managers can ensure that their decisions align with the organisation’s short-term and long-term goals.

Equi-Marginal Principle

The Equi-Marginal Principle is one of the key concepts in Managerial Economics that shapes the decision-making process. It states that rational decision-makers will allocate their resources in such a way as to maximise their utility.

This principle is based on the assumption that the decision maker is rational and seeks to maximise their utility. The utility is often thought of as happiness or satisfaction. So, the Equi-Marginal Principle says that rational decision-makers will use their resources in a way as to maximise their happiness or satisfaction.

The principle can be applied to any situation where there are limited resources and multiple possible uses for those resources. For example, a person might have limited time and money and must choose how to allocate those resources to maximise their utility.

An Equi-Marginal Principle is a powerful tool for making decisions, but it does have some limitations. One limitation is that it assumes that the decision-maker is rational. This may not always be the case, as people sometimes make irrational decisions. Another limitation is that it assumes that utility can be measured, which may not always be possible or accurate.

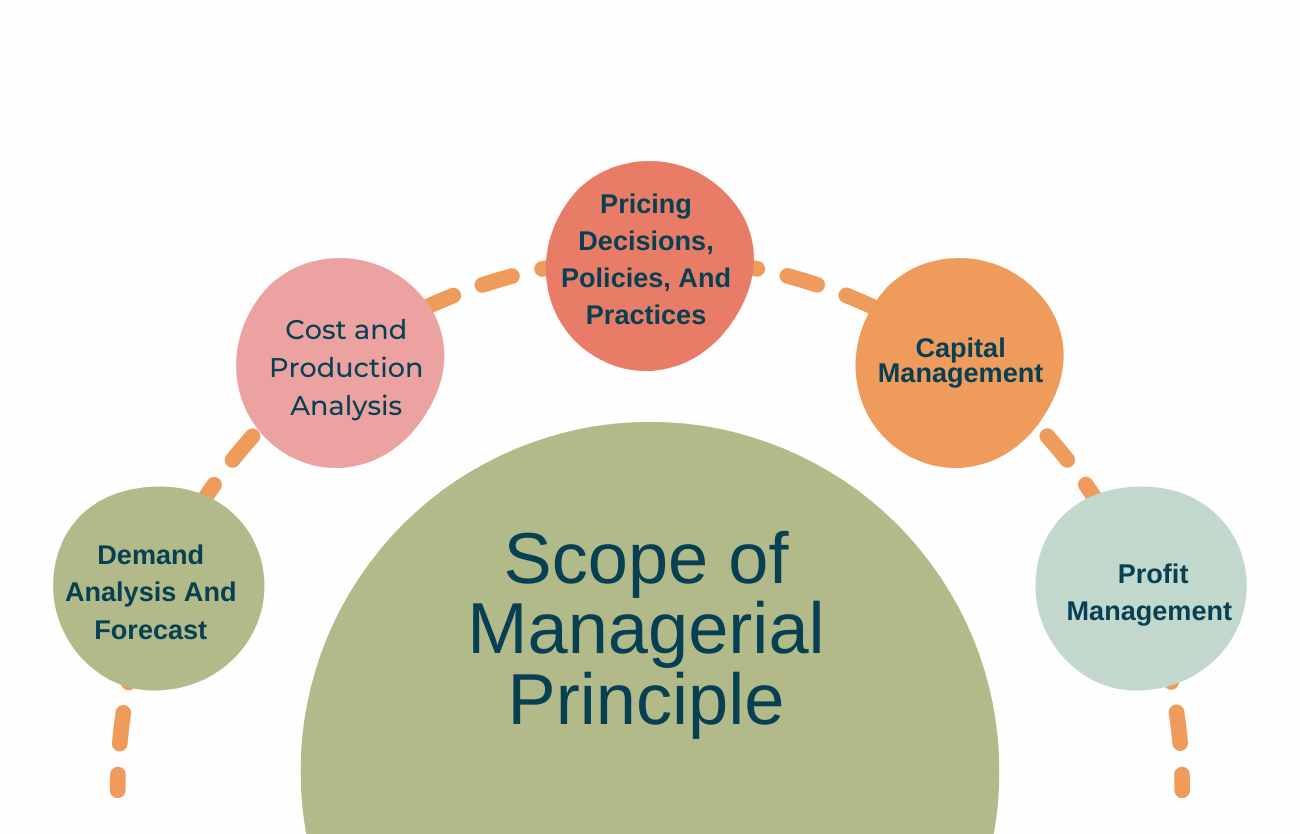

Scope of Managerial Principle

Demand Analysis And Forecast

Managerial economics is a tool that can be used to analyse business decisions and help managers make better choices. The goal of managerial economics is to use economic theory and tools to make business decisions that are efficient and effective.

Some of the topics covered in managerial economics include demand analysis, market structure, game theory, and cost-benefit analysis. Managerial economists use these tools to study how businesses can optimise their production and marketing strategies.

Demand analysis is the study of how consumers behave in different markets. Market structure refers to the way that different markets are organised. Game theory is known as the study of how people interact with each other in strategic situations. Cost-benefit analysis compares the costs with the benefits of different options.

Cost and Production Analysis

In managerial economics, cost and production analysis study how businesses decide what to produce, how, and who to produce it for. It helps managers understand how to optimise resources and minimise costs while still meeting customer demand.

In addition to analysing costs and production, managerial economists also study market trends and the impact of government policies on businesses. This information can help managers make better decisions about pricing, marketing, and other strategic decisions.

There are two main cost and production analysis types: short-run and long-run. In the short run, firms are limited by the amount of capital available. This means that they can only change one factor of production, such as labour while keeping all other factors constant. In the long run, firms can change all factors of production, giving them greater flexibility.

Pricing Decisions, Policies, And Practices

In managerial economics, pricing decisions, policies, and practices broadly fall under the scope of microeconomic analysis. Managerial economists use microeconomic tools to analyse business decisions and strategies. This majorly includes analysing customer behaviour, demand and supply, elasticity, market structure, and other economic concepts.

Managerial economists often work with marketing managers to come up with pricing strategies that maximise profits and meet customer demand. They also help organisations understand how changes in prices will impact their business. For example, if a company is considering raising prices on its products, a managerial economist can help them understand how this will affect demand and what the optimal price increase would be.

Pricing decisions are just one area where managerial economics comes into play. Managerial economists advise organisations on investment decisions, capital budgeting, and other financial decisions. They may also guide on government policy issues that impact businesses.

Capital Management

Managing money – or capital – is critical to success in any business. That’s what capital management is all about: making decisions that ensure a company’s sound financial health.

There are two critical aspects to capital management, i.e., investment and financing. Investment decisions involve using money to buy assets that will generate income for the business. Financing decisions include raising money to fund investments and other activities.

Both investment and financing decisions are essential, but they can be quite different. For example, a company might decide to invest in a new factory, but it will need to finance the construction of the factory with debt or equity.

Managerial economics helps managers make sound capital investment and financing decisions. It provides them with tools and frameworks for analysing problems and making informed decisions.

Also Read: How To Achieve Optimum Professional Growth

Profit Management

Managerial economics applies economic principles and methods to problems faced by managers in all types of organisations.

The scope of managerial economics is extensive. It covers almost all aspects of business decision-making. Managerial economists use economic theory and quantitative methods to help managers make decisions that are in the best interests of their firms. They also study how environmental factors affect businesses, such as government policies, taxes, and competition.

Some of the specific topics that managerial economists often study include demand analysis, production and cost analysis, market structure and pricing, capital budgeting, financial management, and risk management.

Examples of Managerial Economics

To understand what managerial economics is, it is first essential to know the meaning of economics. Economics is essentially the study of how people use resources to satisfy their needs and wants. It focuses on the behaviour of individuals, firms, and governments as they interact with one another in markets.

Managerial economics applies these concepts to help managers make decisions that will improve their firm’s performance. It provides a framework for thinking about how to use scarce resources efficiently and effectively. Managerial economists use tools from microeconomics, which focuses on individual behaviour, and macroeconomics, which looks at the economy as a whole, to analyse problems and predict outcomes.

Some examples of managerial economics include:

- Deciding what products or services to offer customers

- Estimating customer demand for new products or services

- forecasting future sales and profits

- Analysing the impact of government policies on business decisions

- Evaluating the effectiveness of marketing campaigns

- assessing the costs and benefits of investing in new technology

Conclusion

In conclusion, managerial economics is a broad and complex field that blends economic theory and business decision-making. It provides the tools for managers to make informed decisions by analysing changes in demand, supply, cost structure, competition, technological innovations, and other factors. Managerial economics also uses various frameworks, such as game theory and linear programming to help solve business problems.

By studying these fundamentals of managerial economics, managers can gain insight into how their decisions will affect their organisation’s overall performance in terms of profitability or market share. Ultimately, this knowledge helps them make better decisions to increase profits while minimising costs.

Through complex models, managerial economists can provide insight into factors such as pricing strategies, competition, market structure, and production efficiency. All of these elements contribute to successful decision-making in today’s competitive environment. If you are interested in discovering the concept professionally, consider taking our course Executive Development Programme in General Management, which is apt for both professionals and freshers.

टिप्पणियाँ

एक टिप्पणी भेजें