Examples of Effective Customer Feedback Survey Questions

A successful business is a customer-centered business. Putting your customers’ needs and wants at the heart of everything you do is the key to retaining and growing your customer base.

When customers feel listened to, they are more likely to stick around and recommend your products and services. Therefore, asking your customers for feedback is the engine that drives growth within your business.

The most popular method for gathering customer feedback is by sending out surveys. But what makes a good one, and what does that look like? Keep reading as we go through all that and more.

- What are Customer Feedback Surveys?

- Customer Feedback Survey Best Practices

- Examples of Customer Feedback Survey Questions

- Customer Feedback Survey Examples

- Conclusion

Let’s get started.

What Are Customer Feedback Surveys?

Customer feedback surveys are questionnaires that let you collect information on how your customers feel about their experience with your company. This might be regarding a specific product or service, or their overall perception of your brand.

These surveys normally include closed-ended and open-ended questions. The questions will vary depending on what area of the customer experience you are focusing on or on what you are trying to measure. The length of the survey also varies, it could be as short as one question, or much longer.

Why Are Customer Feedback Surveys So Important?

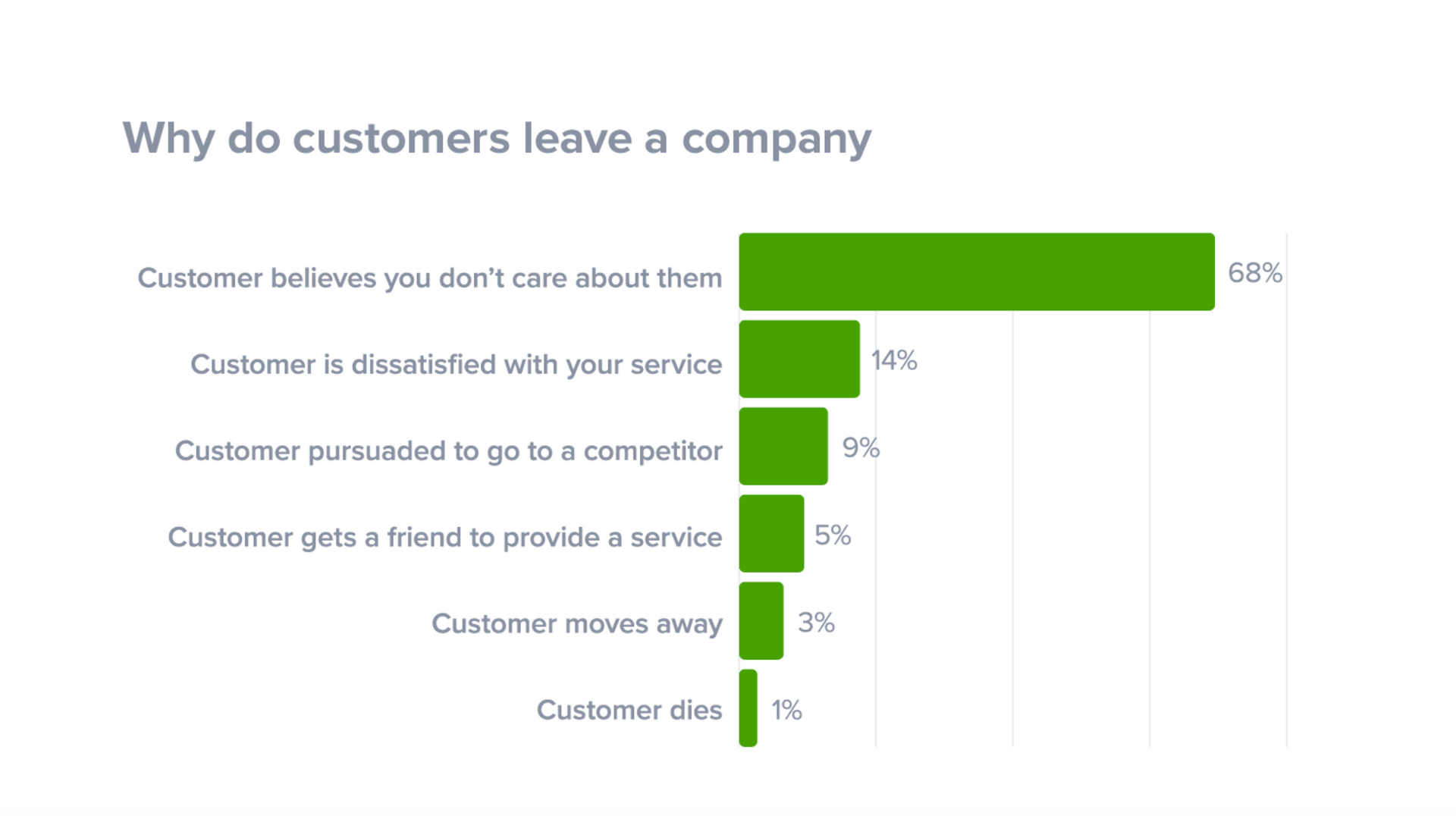

Take a look at this chart from SuperOffice, below. Almost 70% of customers leave a company because they believe you don’t care about them.

That alone should be enough for companies to realize how important customer feedback is.

At the end of the day, you can’t read your customers' minds, so it’s essential that you ask them about their experience with your company, whether negative or positive.

Customer feedback surveys are particularly important because you can tailor surveys around a specific goal. For example, you might want to fix internal issues that are making your customers unhappy.

By asking questions about customer support and what customers would like you to improve, you can gain very specific actionable insights. It’s also a way of letting your customers know that you’re aware of some issues and you’re working towards getting them fixed.

Surveys also help you to detect general trends within different target groups. For example, if you offer both a free and paid plan, you could send a different survey to each group of customers. When the customer responds to the survey, you are then able to prioritize the needs of your paying customerswho ultimately matter more to your business.

Customer surveys are also indispensable when it comes to new products. Before creating new products and services, you need to be sure you’ll be providing something that existing and potential customers are likely to buy. Asking them questions via a survey is the best way to learn their thoughts about these potential new products.

But you should also be strategic about who you choose to ask for feedback. Perhaps there’s a pool of loyal customers that you want to gather feedback from about a beta version of your product. These beta testers probably know your product better than anyone else and will deliver valuable product feedback that can help you make improvements before launching the final product.

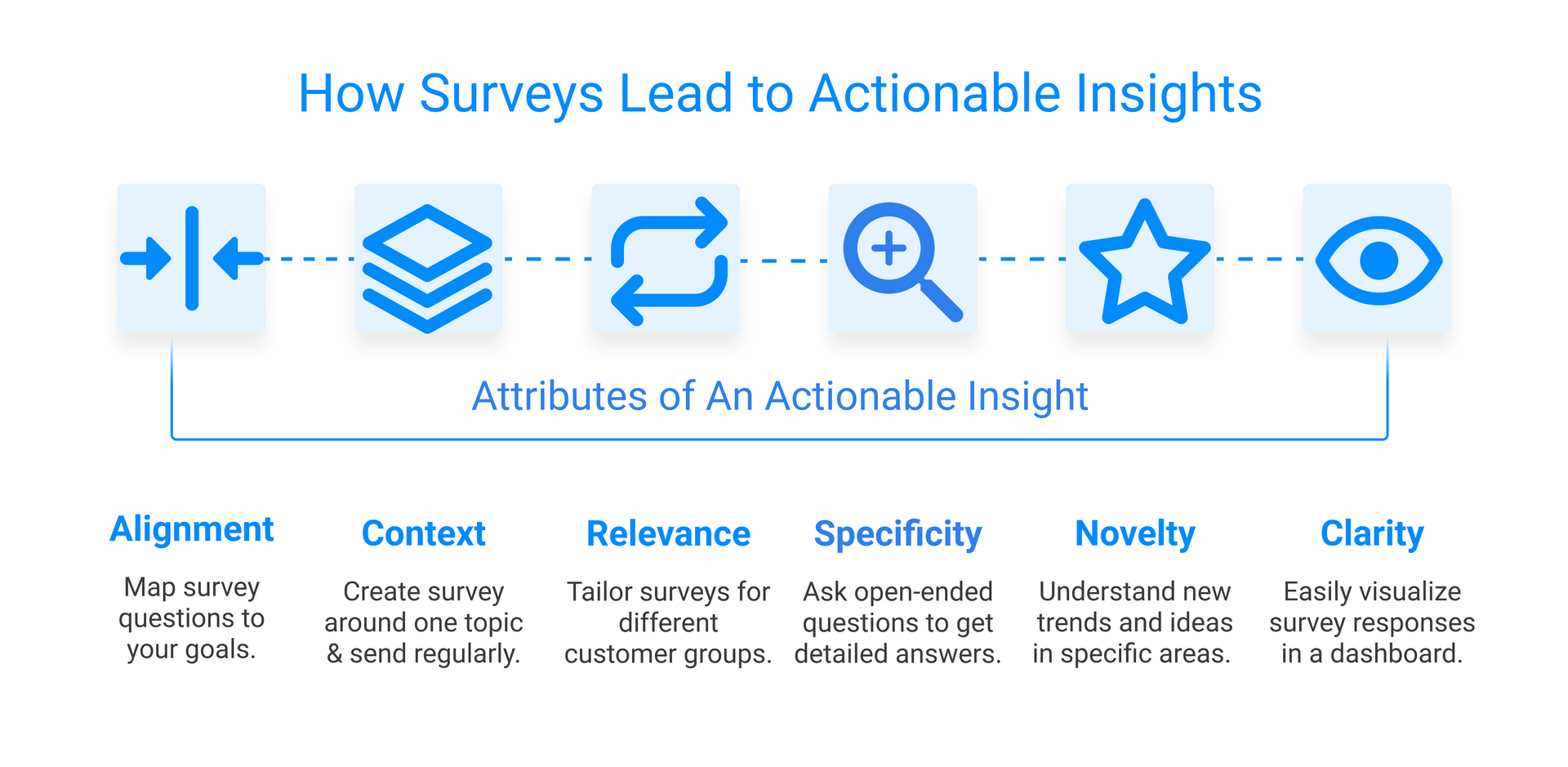

The biggest selling point of customer surveys is that when the questions are tied to your business strategy, or goals, and are timely, you are left with actionable insights.

The following image is a great visual representation of how customer feedback surveys lead to actionable insights:

According to Forbes, an actionable insight can be summarized as information which is aligned to your business goals and for which you have previous benchmarks or context. It also needs to be relevant to your business and specific to a particular touch point. The insight should be new and original. It should also be clear how you can take action.

This all allows you to act promptly to make changes that make a big difference to your customer satisfaction levels. This matters because customer satisfaction is directly linked to loyalty, which, as we know, is connected to repeat sales.

Customer Feedback Survey Best Practices

The success of your survey and the usefulness of the insights it brings will depend largely on the quality of your questions. The right questions will help you gain good data, that you can then use to improve or enhance your customers' experience.

Bad data on the other hand will leave you with very little to work with. This bad data can come in the form of a yes or no question with no further elaboration or context. It might be vague answers, incorrect information, or even empty responses.

Let’s go through some best-practices for writing survey questions so you can prevent bad data from reaching you in the first place.

1. Keep It Short

You want people to actually complete your survey. So, it’s best to keep it short and to the point. This means using less questions and going for quality over quantity, not sending out a survey that never seems to end.

People have short attention spans for surveys. In fact, survey fatigue is a real thing that happens when a respondent gets tired answering survey questions.

Treat your customers’s time with care, otherwise they may not finish your survey or just write anything to fill the field and keep moving forward to the next question (and then end.)

If your respondents complete your survey with an impatient, fatigued feeling, this will lead to more dirty data for you to clean up before analysis and ultimately fewer useful insights.

2. Avoid Questions That Elicit Long Responses

Questions such as ‘tell us everything you like about our company’ or ‘what are all the things you would change about our product’ are too broad. They also encourage the person filling in the survey to give long answers. That might seem like a good thing, more information = more insights right? Not really.

Long answers mean that the respondents have to devote a lot of brain power to answering the question. When this happens, respondents are most likely to suffer from the aforementioned fatigue and might not complete the survey.

If they do choose to go ahead and answer, the lack of specificity in the question will then probably be reflected in the answer. This will make the answer too broad to draw out meaningful insights.

Long vague answers and empty responses equal bad data that are hard to analyze, even with the best analysis tools.

You can avoid these answers by putting a limit on how many characters they enter, or make your questions more specific to narrow the scope of what your customers have to answer.

3. Avoid Biased or Leading Questions

When you send out a survey you want to hear your customers' unique viewpoint and hopefully gain new information that can help you steer your products and services in the right direction. You don’t just want answers that confirm the biases you hold, so you should avoid any leading questions that make the respondent answer in a certain way.

Let’s look at this example of a leading question:

- Do you find our handy new product useful?

Here you are placing your bias in the question with the word handy. Just because you think your product is handy, it doesn’t mean your customer does.

However, if your customer does not find your product useful, you need to know. But adding the word handy, you could over-influence your customer to give an answer they don’t really believe and then miss the insights you need.

4. Target the Right Audiences

Rather than taking a blanket approach, it’s better to act in a targeted way by sorting your customers into groups. The most common ways to segment include demographic, psychographic, geographic and behavioral. However, there are many more ways.

Beyond segmentation you can also target your customers with a contextual survey. An example of a contextual survey is one that pops up while the customer is using your app, asking about their experience with it. This kind of survey gives specific product insights from people who are using it at that moment.

When you segment your audience it may mean that they potentially receive less surveys. However this is definitely a case where less is more.

5. Use Survey Tools

Using the right tools is essential when it comes to creating surveys. Tracking your customers' thoughts and feelings periodically means you’ll most likely have to create and monitor a large amount of information.

This is not something you can do manually, unless you want to lose both time and money. Good survey tools can help you here by automating large parts of the process.

They can help you throughout, from the creation of your survey and the collection of responses through to the tracking of metrics over time. These tools also let you easily connect your results to advanced analysis tools.

6. Keep It Simple

A survey is not the place to write an essay or get creative with your language. In fact, long questions with complicated words and sentences can confuse people enough that they stop reading. Keep your words as simple as possible. For instance, don’t use the word utilize when you can say use and don’t say commence when you can say start.

You should also never double-barrel your questions. This means asking your respondent to rate more than one encounter/experience on just one scale. An example of this could be:

- How would you rate your delivery and purchasing experience on a scale of 1 to 10?

Your customer might have found the purchase experience a breeze and the delivery a nightmare. Asking them to rate them both at the same time is frustrating and won’t lead to very accurate results. For this reason you should always split double-barreled questions.

7. Analyze Your Results

Acting on customer feedback and closing the feedback loop is essential. If you don't, the survey experience can be a waste of time.

But, in order to act, you first need to analyze.

The challenge is that surveys often bring back an overwhelming amount of information, especially with open-ended questions. Going through all of this information is difficult, often impossible, to do manually.

This is why you need efficient and cost-effective text analysis tools, like MonkeyLearn, which can handle this kind of task in seconds using powerful AI backed techniques like keyword extraction and sentiment analysis.

Examples of Customer Feedback Survey Questions

Let’s now take a look at the following 7 examples of different types of survey questions:

- Net Promoter Score questions

- Customer satisfaction questions

- Product questions

- Support questions

- Customer Effort Score questions

- Personal questions

- Open-ended questions

1. Net Promoter Score Questions

As the name suggests, the Net Promoter Score (NPS) survey looks at the number of Promoters you have within your customer base. Promoters are your most loyal customers, those who would recommend you to their friends and family.

The survey shows you your number of Promoters vs Detractors. From there you can then devise your overall NPS score, and assess how loyal your customer base is.

The classic NPS survey question is as follows:

- How likely are you to recommend us to a friend or colleague?

This question will tell you how your customers feel about your company as a whole. To get an idea of how they feel about a particular product or service, you can adapt the question in the following way:

- How likely are you to recommend /[product/service] to a friend or colleague?

By diving into specifics here you are able to pinpoint the exact areas of your customer experience that could be improved. This allows you to swoop in quickly to make changes.

This is the default NPS question. From there you can add an open-ended question to dig further into your score (we’ll go into this in more depth soon). You can also find some more advanced NPS examples here.

2. Customer Satisfaction Questions

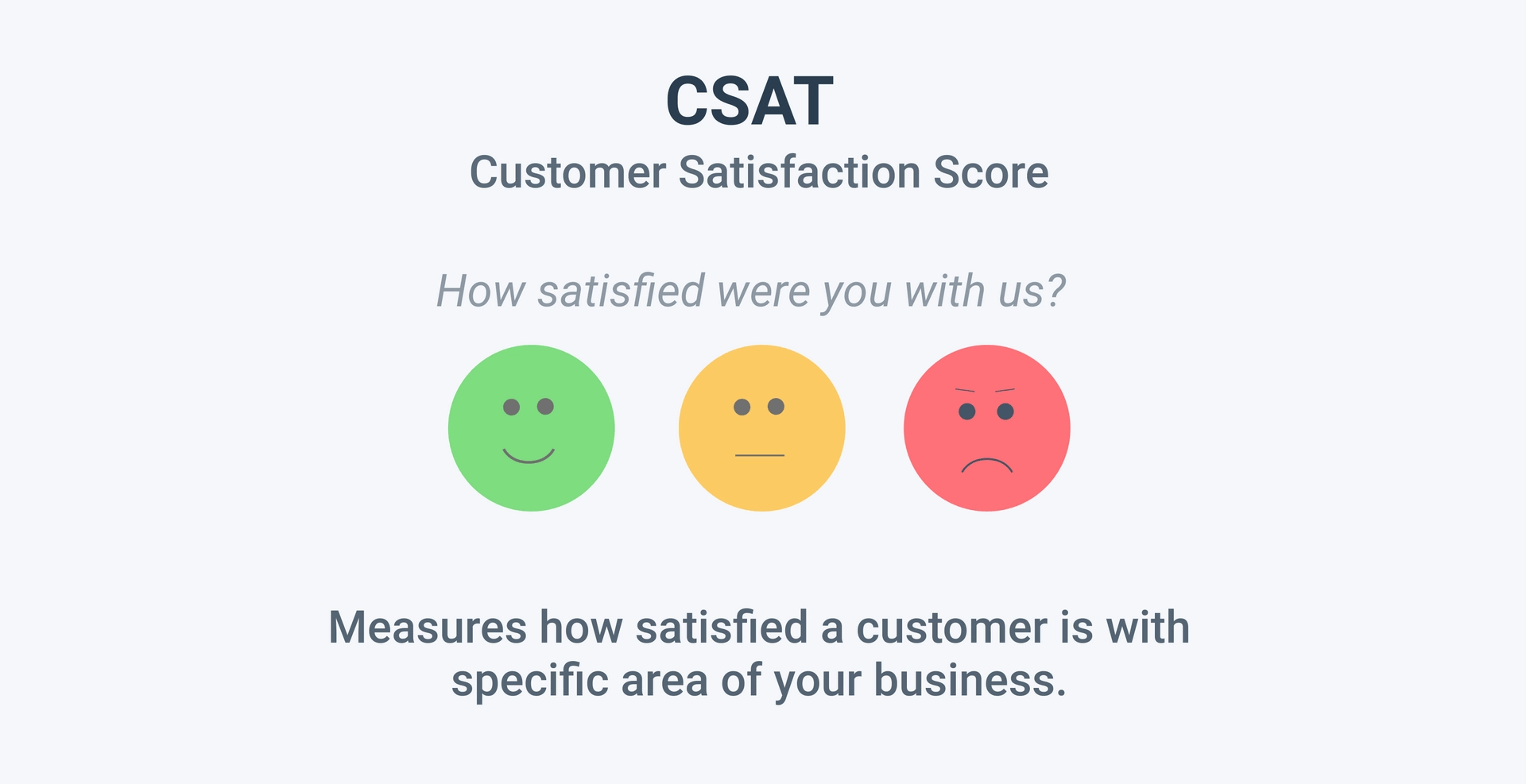

While the NPS is a form of customer satisfaction survey, customer surveys like the Customer Satisfaction Score (CSAT) come at the idea of loyalty in a slightly different way, by directly asking how satisfied customers feel with their experience.

High satisfaction levels are linked closely to loyalty, and loyal customers are what you want. Low satisfaction levels are a red flag that allows you to take stock and make changes to your customer experience.

This question can also be structured in two different ways. One to see satisfaction levels regarding the company as a whole and another to look at specific products and services.

- How satisfied are you with us?

- Did our [product or service] help you solve your needs?

This question is similar to the NPS in that it’s best when combined with an open-ended question. You can also experiment with these questions and tailor them to your specific needs.

3. Product Questions

It’s essential to keep track of your customers’ feelings about your product overtime. Their needs might have changed or the product might not be working as well as it once did.

Customers don’t always offer this information up voluntarily, often they just walk away if something is not working for them. This means you have to go to them with a survey. Here are two examples of what you could include:

- How disappointed would you be if you could no longer use this product?

- How often do you use our product?

Timing is important with product surveys (this applies to most surveys). Try to ask questions about your products when a customer is either using it, or has recently used it. You want the experience to be fresh in their minds.

4. Support Questions

Your customers' experience with your support team makes a big difference to their overall journey with your company. Frustrating customer service experiences can lead to customer churn. In fact, in research conducted by PWC, 32% of respondentsstated they would stop doing business with a brand they love following just one bad experience.

In order to nip any issues in the bud you should regularly question your customers following interactions with your customer service agents. Examples of these questions could include:

- Did our service team member solve your problem?

- How effective was our customer service member?

- How knowledgeable was our service team member?

Again, make sure your survey is sent promptly following an interaction.

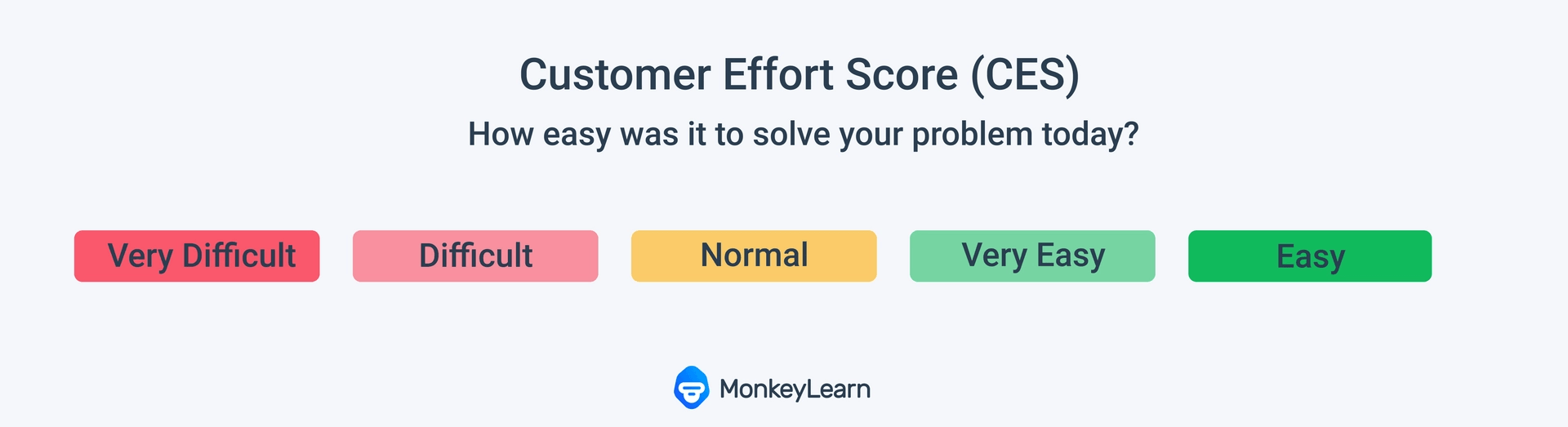

5. Customer Effort Score Questions

Customers really value ease when it comes to interacting with brands. In fact, the effort customers perceive they are putting into interactions with your company is directly linked to loyalty.

In other words, if your customers have to work hard to get their issues solved, they’re more likely to move on to your competitors for an easier experience.

The customer effort score question works best when it is specific to a particular touchpoint. So, it’s best deployed quickly following interactions with a customer service agent, purchase, or a delivery.

The most common Customer Effort Score questions are as follows:

- How easy was it to solve your problem today?

- Which pain points did you encounter while using our product?

These can then be followed by the open-ended questions we have covered.

6. Personal Questions

Asking your customers personal questions helps to build up a buyer persona. This in turn helps you tailor your products and services to better suit their needs and those of potential customers.

When you know what motivates your customer and what they like, it’s easier to predict their needs, then create products and services that they would be likely to purchase.

Personal questions can either be demographic (relating to their gender, age, income) or psychographic (relating to their desires, attitudes, perceptions.) In order to build up a multi-faceted buyer persona, it’s best to combine the two types of questions.

The list of personal information that you could ask for is exhaustive but some examples include:

Demographic:

- Name

- Age

- Marital status

- Job title

Psychographic:

- How many times a week do you eat out at a restaurant?

- Do you prefer to vacation domestically or internationally?

7. Open-Ended Questions

As we’ve touched on, open-ended questionsare essential for your survey. It’s from these questions that you really start to see the insights shine through.

An open-ended question is one that cannot be answered with a yes or no. They are best paired with closed-ended questions to allow the customer to expand on why they have answered a certain question in the way that they did.

Let’s take the example of the classic NPS question we saw earlier. When you add an open-ended question asking why the customer gave the score they did, you can immediately identify if the customer is facing any pain points. From there you work on fixing any issues.

An open-ended NPS question might look like this:

- What is the primary reason for your score?

Whereas, an open-ended question regarding product feedback might look something like this:

- What do you think about the product?

While we love open-ended questions for the insights they give, they are best used sparingly. The respondent has to write full sentences and think more when answering these kinds of questions. This can feel like too much work if there are too many to answer, and your respondents could abandon your survey half-way through.

Customer Feedback Survey Examples

Now, let’s go through some real-life customer feedback survey examples so that you can see the survey questions and best practices we’ve covered in action.

- Amazon - Simple post-delivery survey\

- Apple - Personalized and timely CSAT survey\

- FlixBus - Targeted NPS with time estimate\

- Morning Brew - Buyer persona building survey

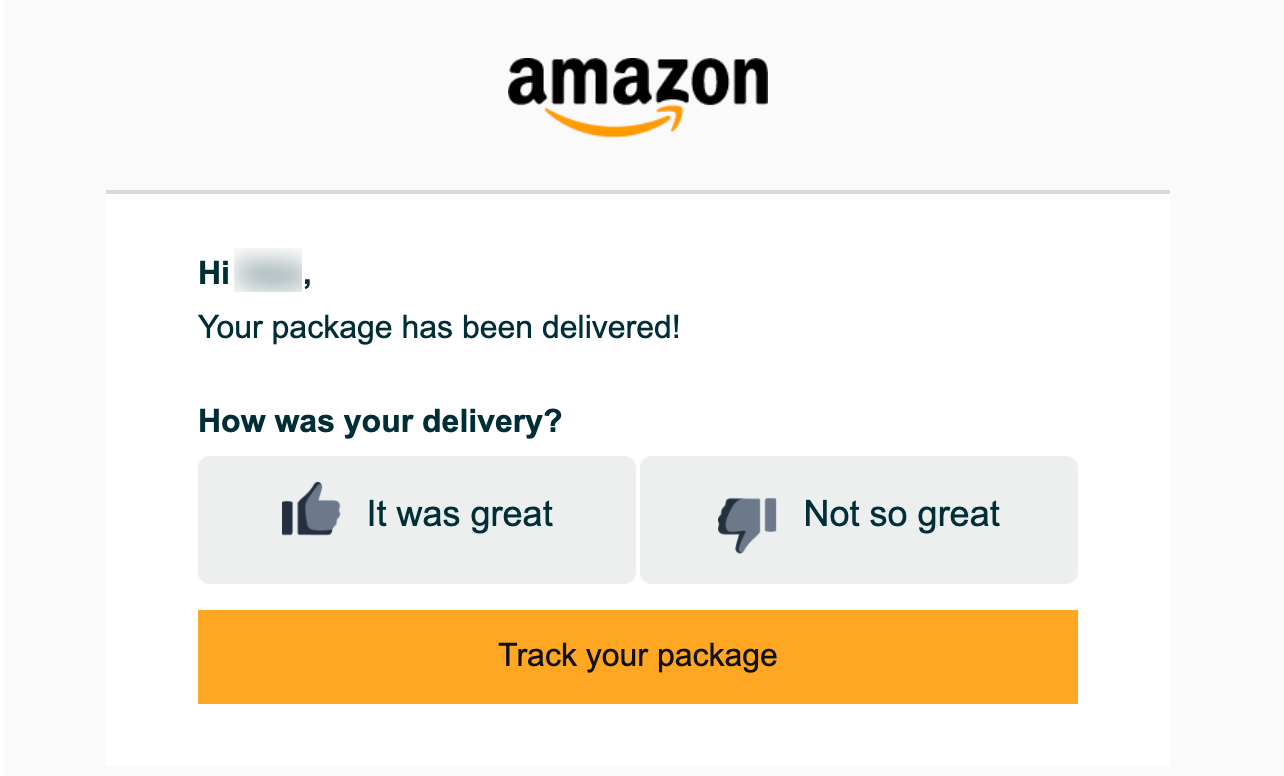

1. Amazon

Amazon has always been a pioneer when it comes to customer-centricity. This is reflected in the way they ask their customers for feedback and then act on this feedback.

This example shows their simple post-delivery survey. It asks just one initial question regarding how the delivery process was for the customer.

This survey is effective because it is short and very easy for the customer to complete. It takes just a second and doesn’t require too many options that could overwhelm them.

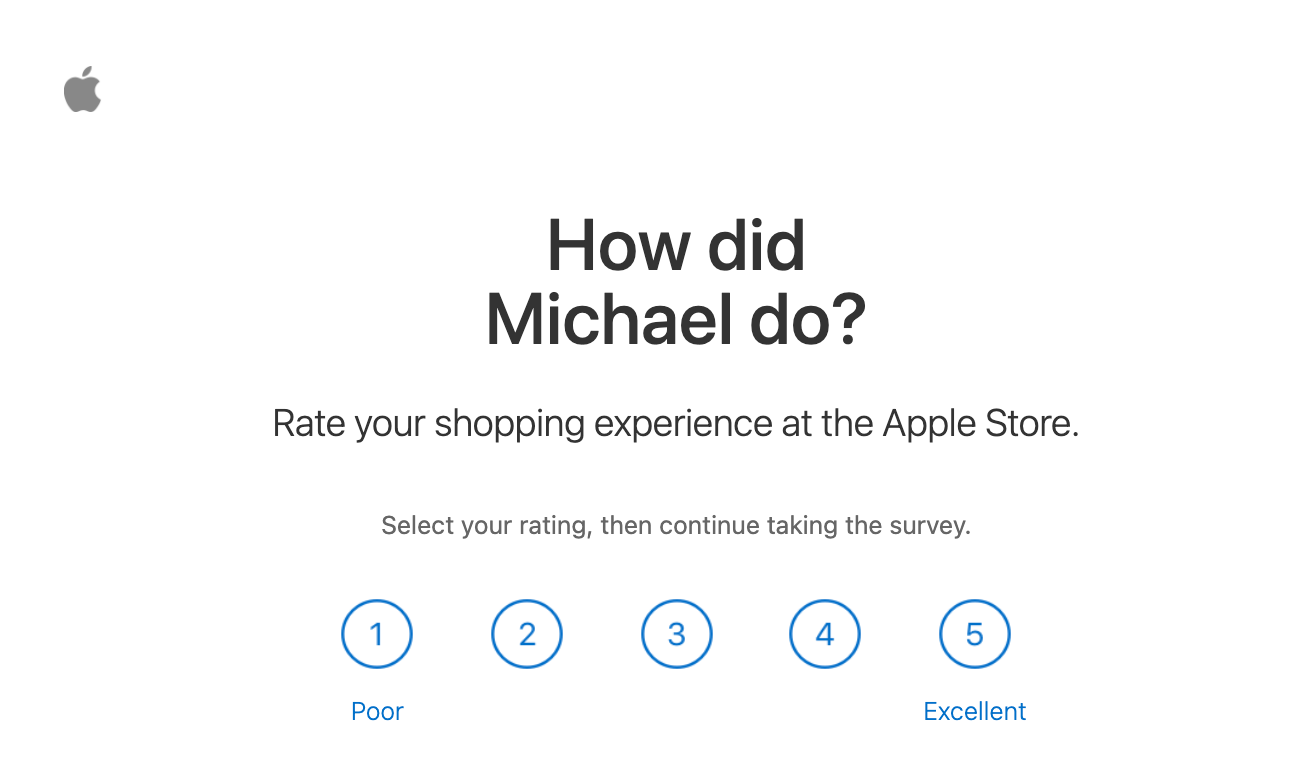

2. Apple

Apple has consistently strong levels of customer satisfaction. Part of their charm is how user-friendly and straightforward their products are to use. This also extends to their customer experience and their surveys.

This survey from Apple is a good example of simple, personalized language being used in the survey question. It’s also specific and timely, they asked Michael to rate his experience at the Apple Store soon after he visited.

There are more questions to come but the opening survey is clear, easy to read and personalized.

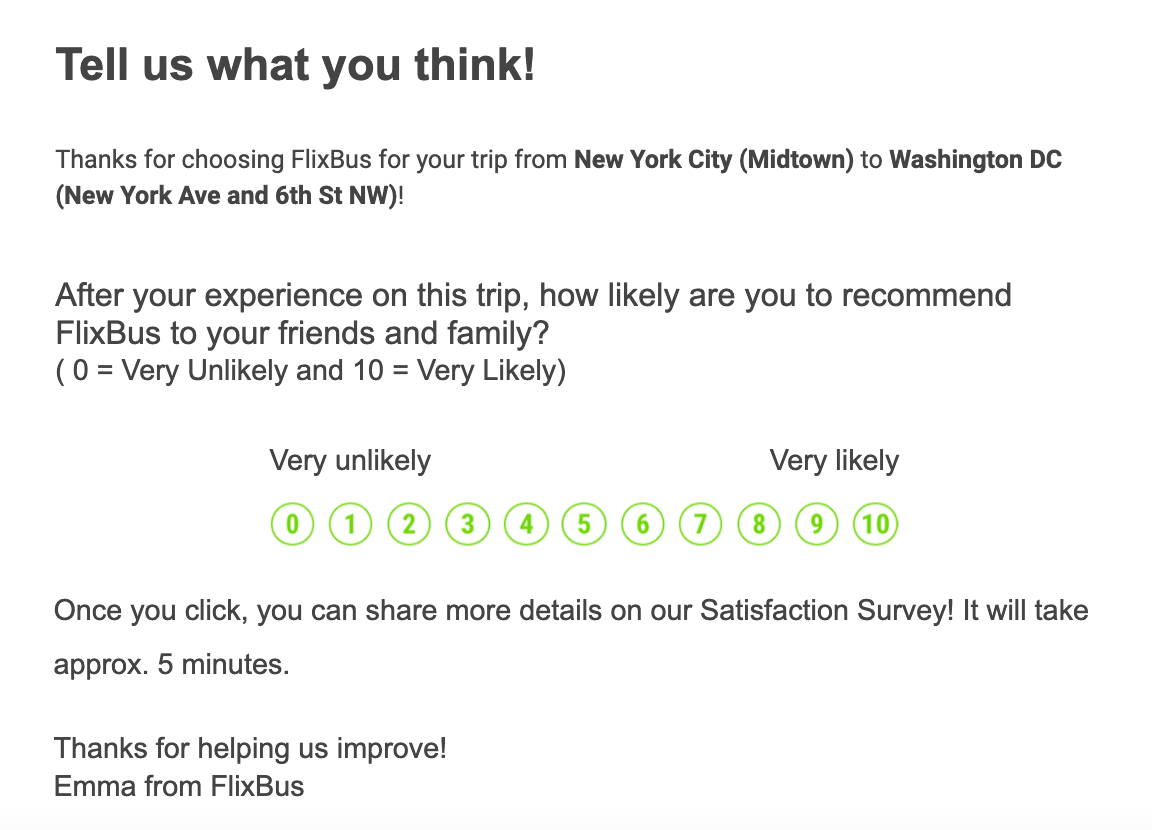

3. Flixbus

Flixbus is an intercity bus service that allows customers to move easily between European and U.S. cities. They provide a low-cost service while still placing high importance on customer satisfaction.

This survey is targeted to a specific interaction the customer had with the company.

It gives the customer an estimate of how much time the survey is going to take them. Five minutes is a manageable amount of time to dedicate, and they know what they are signing up for in advance. This can help to combat fatigue and means there’s more chance the customer will commit to completing the survey.

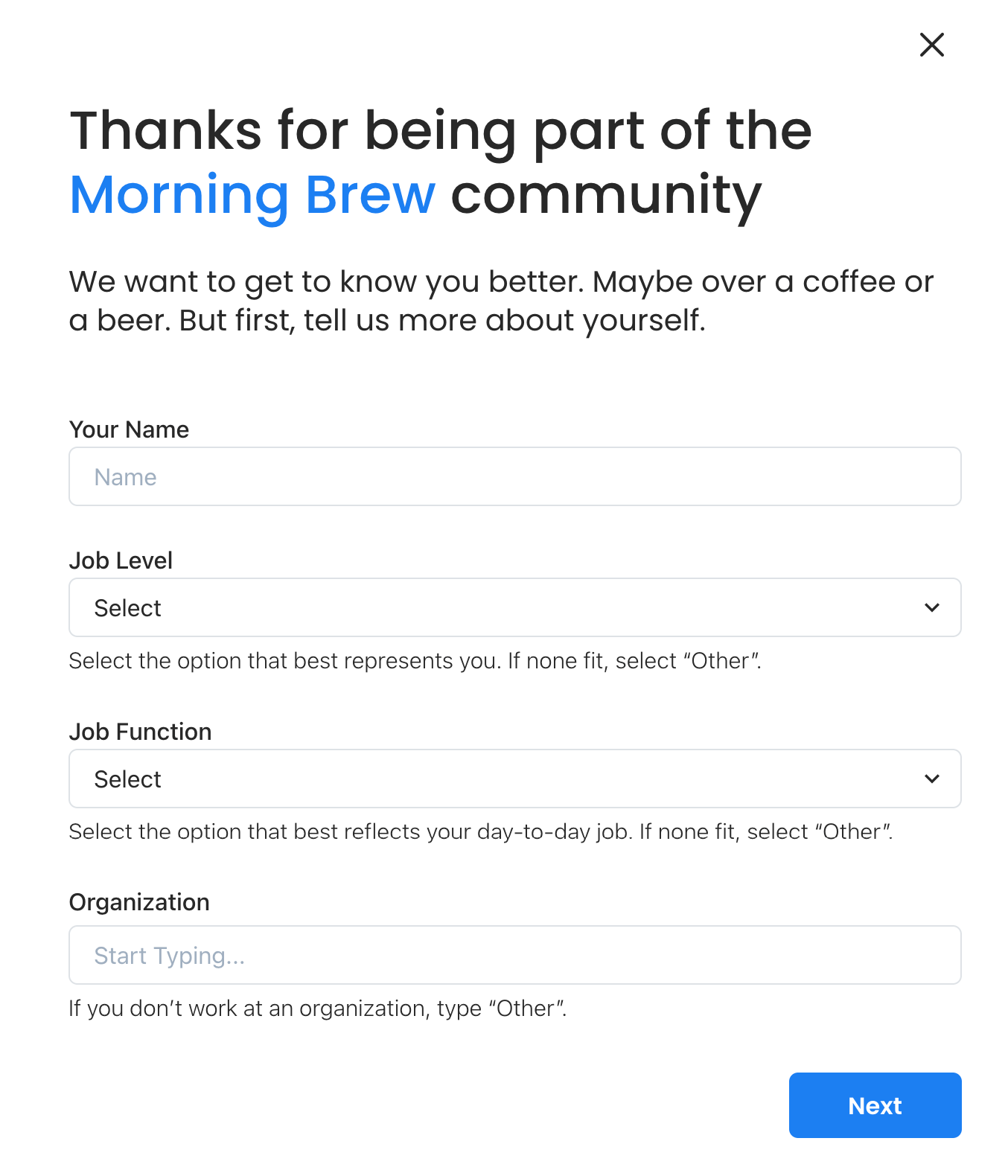

4. Morning Brew

Morning Brew is a daily email tech and business news bulletin. They pride themselves on their loyal subscribers and community feel, and adapt their content according to what their customers want and need.

This is a clear survey that is requesting personal information so that they can get to know their customer and build up their ‘buyer persona’. The language is simple and straightforward. It doesn't waste the respondents’ time. The drop down and autofill fields also make it easier for customers to complete the survey.

Conclusion

A well designed survey is a must when it comes to creating and maintaining a loyal customer base and a profitable, customer-centric business.

Another must is solid survey analysis tools so that help you draw out actionable, objective insights that you can then use to improve your customer experience.

टिप्पणियाँ

एक टिप्पणी भेजें